GUEST BLOG BY LOGAN BLACK https://www.linkedin.com/in/logangblack/

The results of Contract for Difference (CfD) Allocation Round (AR) 4 were announced on 07 July 2022. CfDs were awarded to 93 projects in total to deliver low-carbon energy starting from 2023. This is more than in the previous three rounds combined. In total 10.8 GW of low carbon technology won contracts including nearly 7 GW of offshore wind, more than 2.2 GW of solar and 1.6 GW of onshore wind (including remote island wind).

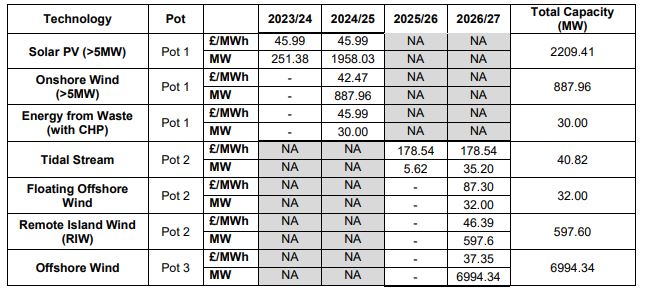

The Clearing Prices* were:

*The prices for CfD’s are expressed in 2012 Money. This means that in todays Money after adjusting for inflation they are ~1.22 times greater. Quirky, right? But it does allow direct comparison between allocation rounds and technologies.

But hold on. What is a CfD?

According to the Department of Business, Energy & Industrial Strategy (BEIS):

The Contracts for Difference (CfD) scheme is the government’s main mechanism for supporting low-carbon electricity generation.

CfDs incentivise investment in renewable energy by providing developers of projects with high upfront costs and long lifetimes with direct protection from volatile wholesale prices, and they protect consumers from paying increased support costs when electricity prices are high.

Successful developers of renewable projects enter into a private law contract with the Low Carbon Contracts Company (LCCC), a government-owned company. Developers are paid a flat (indexed) rate for the electricity they produce over a 15-year period; the difference between the ‘strike price’ (a price for electricity reflecting the cost of investing in a particular low carbon technology) and the ‘reference price’ (a measure of the average market price for electricity in the GB market).

So basically generators compete to get a 15 year contract to buy their electricity at a guaranteed rate – similar to how energy supply companies try to get you on sign on with them by offering the best price. This example is best understood in the context of ‘precedented’ times before almost all the supply companies offer you a tariff at the Cap.

What is significant about AR4?

The results! Obviously. But before we get on to that there were some important changes between AR3.

- Pot 1 was reinstated – Onshore Wind and Solar PV were allowed to compete for the first time in since AR1 in 2013. Developers have still been busy working on their pipelines so you can imagine that this is quite a crowded pot with almost over ten years worth of projects looking for a slice of the pie

- Fixed bottom offshore wind was moved to its own pot, recognising that this is now a mature technology.

- This also means that emerging technologies in Pot 2 have a greater chance at getting a CfD, particularly tidal and floating offshore wind who have their own ringfenced budget.

Now on to the results and what this means.

- Offshore Wind has reduced in cost from £39.65 to £37.35 almost a 6% reduction and is delivering almost 7 GW of power. Including the behemoth Hornsea Three at 2.8GW – this is great value for UK bill payer.

- Onshore Wind clears at £42.47 significantly lower than the ~£80 they got in 2013 when they were last allowed to compete. This figure is probably higher than many expected, but there have been significant increase in capital costs in the past year for various macro-economic reasons so not unsurprising. Important to note that it cleared at a lower cost that solar, but this is more likely to be a quirk of the auction rather than any other significant driver.

- Solar PV clears at £45.99 again lower than the £50 in 2013, but not as low as expected for similar reasons to onshore wind.

- Remote Island Wind clears at £46.39 and dominated Pot 2, with almost 600MW of capacity awarded. Including Stornoway Windfarm, which could now resolve the will they, won’t they situation on the Western Isles Interconnector. Interestingly SSE also bid half the capacity of their 440 MW Viking Wind Farm on Shetland, a project they had already taken investment decision on based on a merchant basis and is currently under construction.

- Tidal and Floating Offshore good to see some off these projects get a contract, and de-risking the technology needed for our future energy system.

This is good for our renewable energy targets, right?

Yes, the UK Government is targeting 30 GW of offshore wind. The current installed capacity is approximately 12 GW. Thanks to AR4 by 2030 we should have an additional 7 GW. This means 9 GW needs to be built in other CfD rounds or find different ways for these projects to be built. So good progress made here.

For onshore wind and solar, not so much, as we only procured 2.2 GW of solar and 1.6 GW of onshore wind (including remote island wind). However, with annual auctions planned this should begin to ramp up close to the figures set out in the recent Energy Security Strategy which includes a 70 GW target for solar, but none for onshore wind.