GUEST BLOG BY LOGAN BLACK https://www.linkedin.com/in/logangblack/

In 2022, there were many significant developments in the UK energy sector. These included:

- political tensions over the supply of energy through interconnectors with other countries, particularly Norway;

- the reintroduction of onshore wind and solar PV to the Contract for Difference;

- high gas and electricity prices and the implementation of a price cap;

- the government taking over the failed energy supplier Bulb;

- The lifting of the onshore wind ban in England;

- the establishment of the Electricity Generator Levy; and

- a review of how our electricity markets work through the Review of Electricity Market Arrangements (REMA) consultation.

While it is possible to discuss the impact of these events in detail, it may also be interesting to consider what the future might hold for the UK energy sector.

I see three key events happening in 2023:

- The spotlight being shed on TNUoS Charges and the need for reform

- The Electricity Generator Levy causing trouble

- CfD Bid prices to increase for this years auction

1. The spotlight being shed on TNUoS Charges and the need for reform

First of all, it’s important to understand what TNUoS charges are. TNUoS (Transmission Network Use of System) charges are fees that are levied on electricity generators and suppliers for the use of the transmission network in the UK. The transmission network is the system of high-voltage power lines and substations that is used to transmit electricity from power stations to distribution networks, which then distribute electricity to homes and businesses. TNUoS charges are set by the National Grid and are designed to cover the costs of operating, maintaining, and developing the transmission network.

The TNUoS mechanism is a system designed to incentivize the efficient placement of electricity generation. Under this system, charges are lower or even negative in areas with high demand, in order to send a price signal and encourage centralised generation near cities and industries. This was originally intended to minimize the distance that electricity needed to be transmitted, but as the UK moves towards a net-zero economy, the best sites for renewable energy generation (such as offshore and onshore wind) may be located at the edges of the transmission network, where TNUoS charges are higher. This can make it more difficult for investors to fund renewable energy projects and may mean that we don’t achieve our 2030 and 2050 targets.

This is a bad starting point, and when you consider that National Grid’s Pathway to 2030 has an estimated £54 billion cost, the majority of which will fall on to the TNUoS charges renewable energy projects we are looking to encourage. The pathway to 2030 is a positive development and National Grid are making the investment needed for out transmission networks, but some serious thought needs to be given to the future of TNUoS charges and what we want to encourage

2. The Electricity Generator Levy causing trouble

The UK government has announced a new temporary tax on the excess profits of low carbon electricity generators, such as nuclear, renewables, and biomass. The tax, called the Electricity Generator Levy (EGL), will be 45% and will apply to excess profits above £75/MWh. The EGL will last until March 2028. Projects with certain contracts and storage technologies are exempt from this tax, as are fossil fuel generators.

I am not in favour of the Electricity Generator Levy (EGL) because I think it will discourage investment in low carbon projects. This is due to its long duration, the fact that it will apply to projects that have not yet reached the investment decision stage, and the potential to create a negative policy environment, which investors do not like

Well that’s my view – now the trouble. This comes in two parts.

- Community Wind Power, an onshore wind developer with a 1.5GW portfolio, has hired lawyers to take legal action against the government over the EGL and try to block the tax through a judicial review. The legal action is based on the argument that the new tax goes against the government’s own Net Zero strategy.

- The implementation of the Electricity Generator Levy (EGL) could jeopardise the plans to extend the operation of two UK nuclear plants beyond 2024. The levy could negatively impact the business case for the Heysham 1 and Hartlepool power stations to continue operating. This could have significant consequences for the UK’s electricity supply security. The combined capacity of the two plants is over 2.3GW, and the margin of error for this winter was 3.7GW, which is a cause for serious concern.

3. CfD Bid prices to increase for this years auction

In the UK, the Contracts for Difference (CfD) is a system that provides financial support for low carbon electricity generation projects. It is a key policy in the UK’s efforts to decarbonise its electricity sector and meet its climate targets. Under the CfD, eligible projects are awarded long-term contracts to sell their electricity at a fixed price, which is set at a level that provides the project with a stable revenue stream. This helps to reduce the financial risks associated with developing low carbon electricity projects, such as wind and solar farms, and makes it more attractive for investors to fund them.

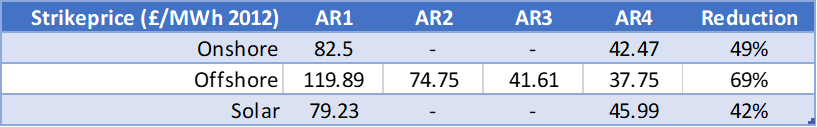

With each CfD allocation prices have fallen between AR1 in 2015 and AR4 in 2022 costs per MWh have fallen significantly, onshore wind reducing by almost 50%, offshore by 69% and solar by 42%. Actual reductions are show in the table below.

With AR5 due to take place this summer, it seems likely that project costs will increase due to the current macroeconomic environment. High inflation and high cost of debt, as well as an inconsistent UK energy policy are not favourable conditions. Additionally, major wind turbine manufacturers like GE, VESTAS, and SGRE are not making profits, and competition in the global renewable energy industry has increased. Project developers will also be looking at alternative routes to market such as corporate PPAs, which may offer more value to them or a more palatable risk profile. Given these factors, it seems likely that costs will continue to rise.

BONUS: Shortage of talent to be an issue

This is a pressing issue in the renewable energy industry, and it is likely to become even more pressing in 2023. With Developers, governments, and transmission and distribution networks all preparing for a lot of work as we approach the 2030 Net Zero target. We need to attract more people, including both new graduates and experienced professionals from other industries, to the renewable energy sector in order to achieve our goals. We need a lot more people to deliver on our ambitions and we need to get them on board quickly.

What do you think will happen in 2023? Let me know in the comments!